Are you looking for the most promising DeFi platforms to invest in for 2024? The decentralised finance (DeFi) landscape is evolving rapidly. So, staying ahead requires being informed about where the smart money is moving.

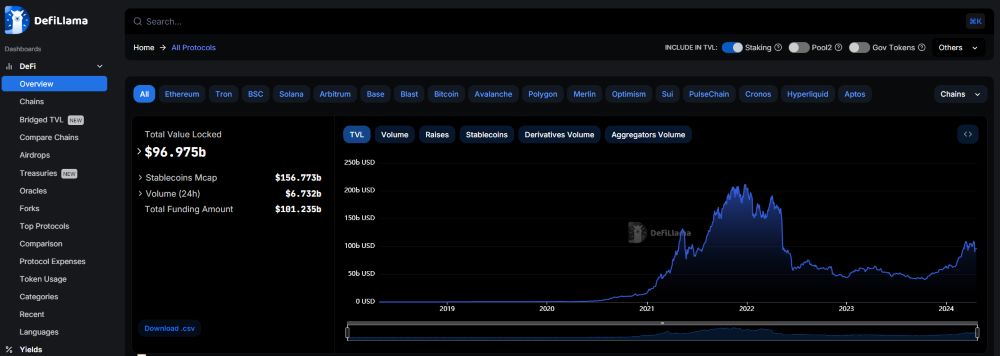

As of now, the total value locked (TVL) in DeFi has soared past $90 billion, marking a significant year-over-year increase. Here’s a rundown of the top 10 emerging DeFi platforms that you should keep an eye on.

1. Lido (LDO)

Lido is currently the largest liquid stacking protocol in the DeFi space. With a Total Value Locked (TVL) of approximately $28.69 billion. It dominates by offering you flexibility to stake and unstake your crypto anytime across multiple blockchains like Ethereum and Polygon. This massive TVL reflects strong community trust and positions Lido as a leader in liquid staking.

2. Aave (AAVE)

Aave’s Total Value Locked (TVL) stands at approximately $10.7 billion. among the top decentralised lending platforms in the DeFi space. Aave operates across multiple blockchains and offers unique features like flash loans and collateral swapping. Despite new competitors and market dynamics, Aave remains a key player for those looking for flexible DeFi lending solutions.

3. MakerDAO (MKR)

MakerDAO currently holds a Total Value Locked (TVL) of approximately $5.636 billion, slightly less than previously reported. It remains a key player in the DeFi sector, known for its DAI stablecoin and robust decentralised governance model. MakerDAO allows users to deposit various crypto as collateral to mint DAI. This ensures stability and reliability as a medium of exchange in the unpredictable crypto market.

4. EigenLayer

EigenLayer’s TVL has rapidly climbed to approximately $10.4 billion. This growth is driven by its advanced restaking solutions and substantial Ethereum deposits. This marks EigenLayer as a significant force reshaping the staking dynamics within the DeFi ecosystem.

5. Uniswap (UNI)

Uniswap’s Total Value Locked (TVL) is now about $5.534 billion, not the previously reported $3.2 billion. Known for charging no fees to list coins and enabling trading across a variety of ERC-20 tokens on multiple blockchains. This makes Uniswap a go-to for users seeking flexibility in trading options without the typical costs associated with other platforms.

6. JustLend (JST)

JustLend, TRON’s official lending platform, currently holds a Total Value Locked (TVL) of about $5.9 billion. This makes it a major driver of TRON’s status as the third-largest blockchain by TVL in the DeFi sector. JustLend supports the TRON network by enabling decentralised borrowing and lending of its assets, significantly enhancing its liquidity and utility.

7. Compound (COMP)

The TVL for Compound is currently around $892.647 million, which is lower than the previously mentioned $2.7 billion. Compound continues to be a major player in the decentralised lending market, supporting various cryptocurrencies. This allows users to either earn interest on their digital assets or use them as collateral to borrow.

8. Curve Finance (CRV)

Curve Finance has a TVL of about $3.99 billion, making it a key player in the DeFi sector. It specializes in stablecoins and offers efficient, low-slippage trading. This focus on stablecoin liquidity makes it a reliable choice for fast trading needs in the DeFi markets.

9. Balancer (BAL)

Balancer’s Total Value Locked (TVL) currently stands at approximately $1.25 billion. It operates as a dex and automated portfolio manager. Renowned for its capacity to manage pools with up to eight different cryptocurrencies. These pools automatically adjust their allocations to offer a self-balancing investment strategy. This makes Balancer a notable platform for diversifying crypto holdings efficiently.

10. PancakeSwap (CAKE)

PancakeSwap currently holds a TVL of approximately $2.95 billion, making it the largest decentralised exchange on the BSC network. It offers a wide range of DeFi services like staking, yield farming, and an intuitive trading interface. This is the reason why it continues to draw a substantial user base. This growth reflects its robust platform capabilities and user-friendly features that cater to various DeFi activities.

Take the Next Step in Your DeFi Journey

Now you’re armed with the latest on the top DeFi platforms for 2024, it’s time to act. These platforms are designed to suit a range of needs. Whether you’re looking to diversify your investments or explore new DeFi services

Check out more detailed analyses and updates on DeFi developments in my other blog posts. Contact me for specialised DeFi content writing services. Take advantage of your opportunities in the ever-evolving world of decentralised finance.

Top 10 DeFi Platforms to Watch in 2024 – FAQs

What are the top DeFi projects in 2024?

The top DeFi projects in 2024 include Lido, Aave, and MakerDAO. This is due to their significant total value locked (TVL), and innovative services like staking, lending, and stablecoin offerings. These platforms are recognized for their influential roles and consistent performance in the DeFi sector.

Which crypto will boom in 2024?

Predicting which cryptocurrency will boom in 2024 can be speculative;. However, tokens associated with leading DeFi platforms like Lido’s LDO, Aave’s AAVE, and Curve’s CRV have shown strong potential.

Which DeFi platform is best?

The best DeFi platform depends on what you’re looking for. If you need liquidity and staking options, Lido stands out. For a wide range of lending and borrowing services, Aave is a top choice. For trading stablecoins efficiently with minimal slippage, Curve excels. Match the platform to your investment strategy and specific needs.